Using Your Finances for Meaningful Change.

Before starting my business, I had spent most of my career working in non-profits. There were a lot of hours for pretty measly pay but your reward was supposed to be supporting a cause or organization you believed in. It was supposed to feel great to help out, but often you felt burnt out, overworked and underappreciated. And you rarely got to do the “fun” work that the organization represented because you were doing your desk job to support that work.

Later, I shifted to working for a community-minded for-profit and that experience was vastly different. Hours were still long and the tasks of the job were not always stimulating, but the pay and benefits were much better. They also allocated time and money into real staff development and continuing education programs, including tuition matching for advanced degrees that benefited your position. And they used their capital and employees time in the community all the time. They had a budget for community donations and staff could recommend projects or organizations for funding. They gave staff an annual time allotment for volunteering on company time and encouraged staff to join local boards or to find consistent opportunities to volunteer. They organized staff volunteering days and sponsored tables at fundraising events and gave the spots to staff. I thought I was going to be less connected to the community when I left the non-profit world, but I actually had more opportunities for direct involvement.

As I started to formulate a plan for my own business, I wanted to use these two types of experiences to inform how my business participated in the community. I had seen both-sides of the coin and I had strong ideas about what I wanted to cultivate and support in my own business as it grew. Some of the values that have been woven into the culture of Missoula Bookkeeper include: being a great boss, preaching and practicing work/life balance, being fiscally responsible, supporting local organizations.

As a single mom in what is becoming an increasingly high cost of living community, I have to be aware of my bottom line, but I also want to give back to this amazing community that has nurtured my business. Here are a few things I have intentionally implemented in the past few years: paying livable wages to employees with regular cost of living assessments and raises, bi-annual staff retreats to get feedback, thank employees and plan for the next 6 months, creating financial stability for my team so we can be more present and participatory citizens, supporting several non-profit boards, sponsoring 2-3 fundraising events per year and consistently stepping back to assess and refocus for the betterment of the company.

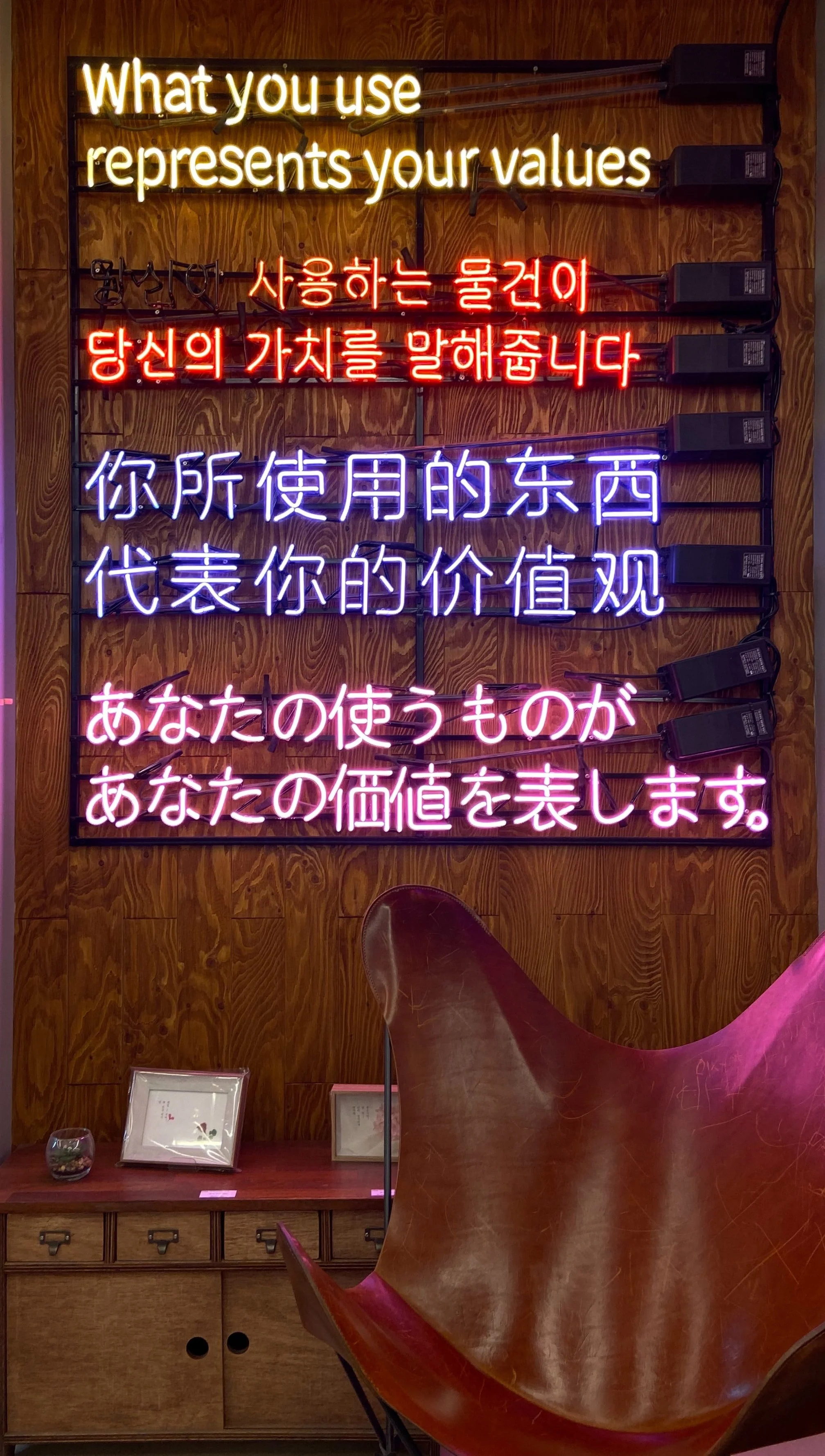

This month we are going to explore how to make sure your personal and corporate values are really informing the choices you make in your business. Here are some of the things we will look at:

Looking at vendors, customers, and service providers to make sure that they have values that align with yours - are you supporting companies that donate to causes or candidates that you disagree with? Do the companies that you associate with use business practices, ingredients or processes that align with your values? Is your choice of bank, financial advisor and investments responsible?

Finding local causes to align yourself in ways other than direct cash donation. This may mean sponsoring events, joining a board or offering products for silent auctions or other fundraising.

Having ethical and thoughtful personal policies. This could include pay structure, benefits, time off policies, systems for employee review and recognition, professional development and staff appreciation.

Choosing causes and nonprofits to donate to and how to know if they are spending their donations responsibly.

What values do you want your business to embody? How have you worked to have a value-guided business?

REMEMBER:

Keep in mind: serving a charity with your time is an amazing gift, but it’s not a tax deductible one. If you are looking to donate with a tax benefit, stick to gifts of money or product.

Charitable Write Offs

When it comes to charitable donation write offs, the limit is $300. That doesn’t leave you much room tax-wise if you want to do more. Here’s a tip we learned from one of our favorite CPAs: some types of donations can be counted as an advertising expense to maximize your write offs. Check with your accountant or bookkeeper for advice about what kind of donations can qualify.